How to build trust in your market data providers

A guide for advanced market data monitoring pt. 1

In fast-paced trading environments, the reliability and timeliness of your market data can make the difference between profit and loss. Taking steps to safeguard data quality is crucial for seizing market opportunities, managing risk, and staying ahead of the competition.

The rise of cloud technology and the integration of artificial intelligence (AI) in trading systems have introduced new challenges to sustaining data quality. Cloud technology has made it easier for financial institutions to access datasets, amplifying the variety and quantity of market data available. AI and machine learning, meanwhile, has increased both the quantity and velocity of market data with its ability to rapidly process structured and unstructured information.

While implementing these technologies, it is imperative to protect data quality and trading performance. In our three-part guide, we will take you through how ITRS Geneos enables advanced market data monitoring .

First, we’ll start with building trust in your data providers.

Understanding raw latency forms the basis of trust

Making sure external market data is timely and up-to-date lays the groundwork for building trust in your feed providers. To achieve this, you need real-time insight into the performance of your market feeds.

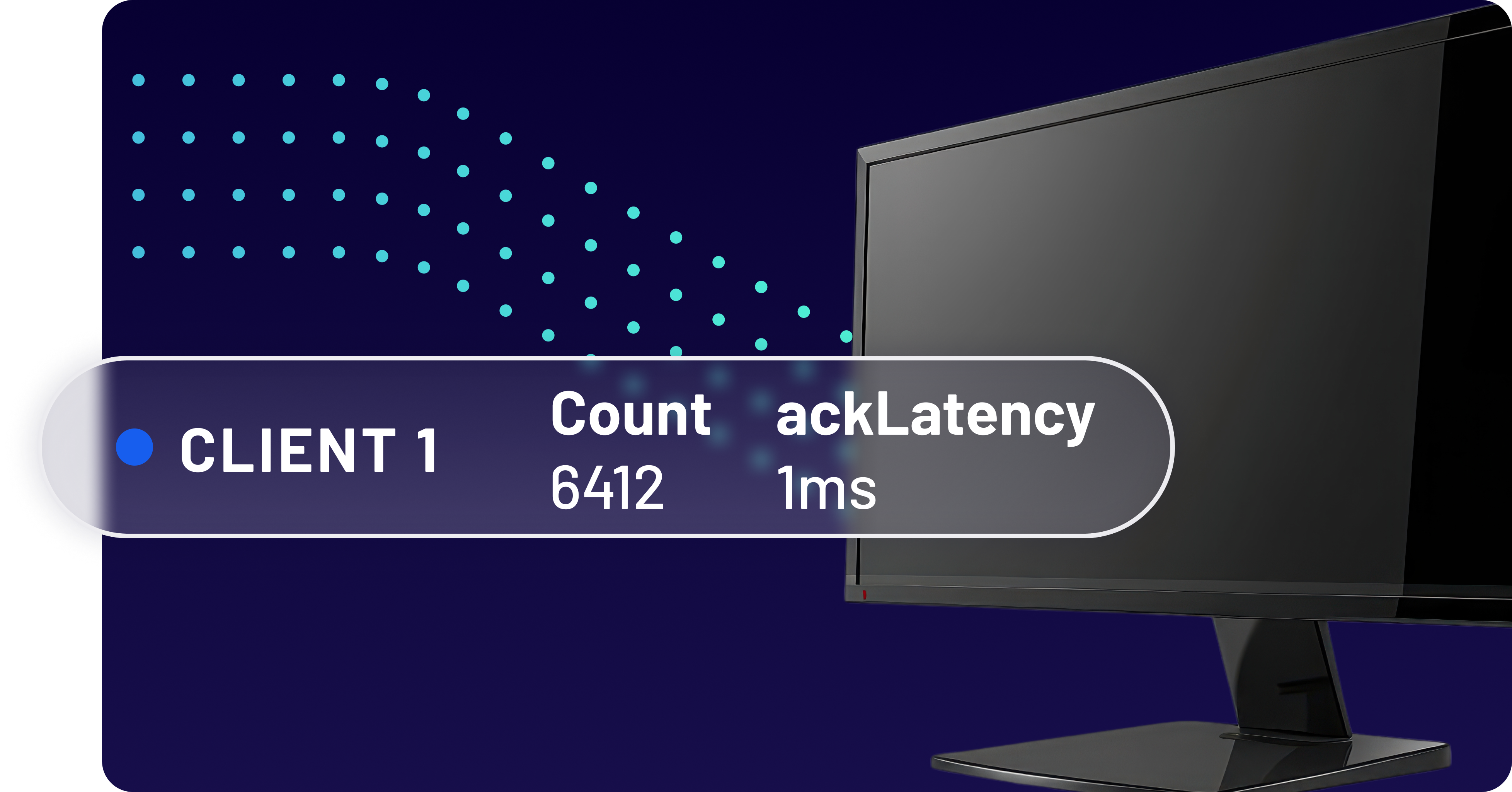

ITRS Geneos Market Data Monitoring (MDM) subscribes to your market feeds to deduce raw latency from publish and receipt time stamps, evaluating the time taken to run calculations. With its data visualization capabilities, Geneos MDM plots latency over time so you can see if latency is trending up or down. This gives you visibility of feed performance, which is a critical first step for determining and trusting in the quality of data provided by an external source.

Using Geneos MDM’s highly scalable back-end analytics platform, you can indefinitely store latency and derived metrics, percentiles, and standard deviations at full fidelity, allowing you to utilize this data for historical analysis and real-time alerting.

Turning real-time insight into action

The latency of your market feeds fluctuates over the trading day. Historical analysis helps you identify recurring trends in latency, for instance if it dips at certain times of the day or week. Geneos MDM’s visualizes these fluctuations and lets you establish normal benchmarks for feed latency. By overlaying your real-time latency metrics, you can look at the variance between current and expected latency.

As a result, you can determine custom latency thresholds and proactively identify issues before they impact trading activity. You can configure real-time alerts to warn you of emerging problems, pinpoint if the issue is with a provider or an exchange, and carry out remediations such as automating the switch to a secondary source.

Geneos MDM is designed to rigorously monitor market feeds and translate high volumes of data into actionable insight in real time. Not only does it give you immediate visibility of individual feed performance, it also lets you take this further to run comparisons between feeds and automate source optimizations.

To learn more, head over to part two of our best practices for advanced market data monitoring series.