LAMA reporting: Failure is not an option

To comply with India’s “technical glitches” regulation LAMA, brokerage firms need a monitoring platform that can provide a single-pane-of-glass view of their IT as well as perform analytics on runtime data in real time.

Rise of technology risk

Over the past 20 years, due to adoption of rapid technological developments, the Indian Securities market has grown exponentially. The National Stock Exchange of India (NSE) is the world’s largest derivatives market by number of contracts traded. The rapid rise of the industry, while on one hand has made investing and trading easily accessible to the retail market participants, on the other hand the volume and speed has introduced technological challenges in terms of capacity, operational risk, and technology risk.

Considering the growing number of technological incidents or outages across market participants, the market regulator - Securities and Exchange Board of India (SEBI) - created a working group to recommend suitable measures to address the issue.

Framework to address the “technical glitches”

In November 2022, SEBI released a circular laying out the framework to address the technical glitches in stockbrokers’ electronic trading systems:

• “Technical glitch” was formally defined

• It included not just the network, hardware, and software but also the broker processes and services

• Stoppage, slowness, or variance in normal functions/operations/services were brought in the scope of a “glitch”

• The glitch, if lasts more than five minutes, is now mandated to be reported

• Exchanges need to be informed within an hour’s time, while preliminary reports can be filed the next day

• Detailed root cause analysis (RCA) is now required to be filed in 14 days

• There will be considerable financial fines for repeated glitches.

API-based Logging and Monitoring Mechanism (LAMA)

In what is perhaps a first globally, SEBI proposed a proactive monitoring and statistics dissemination API to be made available by stock exchanges, now popularly known as the LAMA platform.

In order to minimize any operational redundancy, and therefore the added costs of hosting by five operational stock exchanges in India, it is widely understood that NSE will host the platform and the other exchanges will share the costs. The brokers will need to connect to only one platform of LAMA. (The LAMA reporting platform at NSE has been operational since 1st April 2023.)

The key metrics to be reported in the LAMA reporting system, applicable to the top 35 retail brokers in India, are below:

• Reporting is to be done at five minutes frequency

• Key parameters of applications, systems and networks are to be reported

• Critical systems include client connectivity, order management systems, risk management systems and exchange connectivity.

Challenges faced by brokers in setting up LAMA monitoring

Though brokers at large overseas investment banks already have real time end-to-end monitoring tools, many of the home-grown local brokers have either developed their own monitoring tools or have disparate tools monitoring different aspects of the environment.

Many brokers are facing the below challenges:

• Existing monitoring reporting is at inconsistent intervals

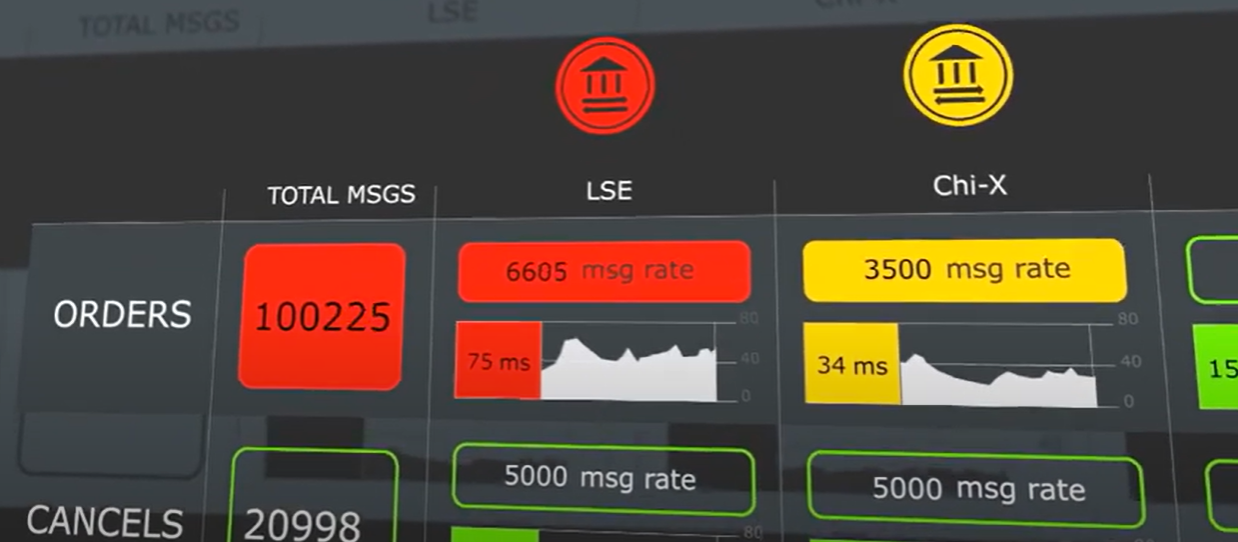

• Lack of a monitor of monitors – no single-pane-of-glass view

• Inability to perform analytics on monitoring data in runtime.

ITRS Geneos for enterprise real-time monitoring and LAMA reporting

Over the past 25 years, ITRS Geneos has been the enterprise tool of choice for global investment banks and market participants. Developed through experience of implementation over 200+ similar environments, Geneos market-specific tools and plugins which help rapidly deploy real-time monitoring across the entire IT stack.

Geneos also provides a custom scripting example for LAMA, to create custom solutions using the API’s scripts and database queries. Furthermore, automatic or single click actions on alerts aid setting up of auto healing and auto remediation -helping brokers meet the MTTR and SLA requirements.

The ITRS LAMA solution helps monitor all the required key KPI’s and helps report into the LAMA system. The solution is now available for brokers requiring assistance in meeting the LAMA compliance.

To see how ITRS Geneos can help you monitor your systems in real-time, contact us by clicking here.