["Whitepaper"]"0""0"

Technological and regulatory change in APAC in the face of global disruption

Operational resilience has been in the spotlight for a few years now due to several high-profile outages which have caused large reputational and financial losses to major players in the financial sector and beyond.

In recent months, the pressure on financial services organisations has ramped up even more with repeated calls for a more robust approach to operational resilience and the announcement of upcoming regulations in some key Asia-Pacific (APAC) markets.

In this whitepaper, we explore:

- Key operational resilience trends in the Asia-Pacific region.

- How financial firms can prepare by keeping their critical systems running and their businesses performing, all while complying with increasing regulatory pressure.

- Trends in operational resilience around the world and what they mean in an interconnected, global financial market.

Related posts

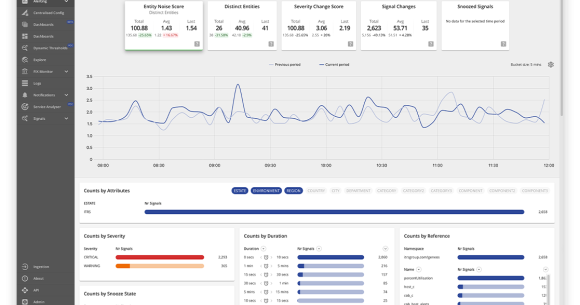

Predict outages and protect critical systems

BSP-Ready. Resilience-First. Powered by Geneos

Stay ahead of Bangko Sentral ng Pilipinas (BSP) operational resilience mandates with Geneos 7. Map critical operations, monitor third-party risks, simulate disruptions, and scale with confidence.

The Vital Role of Market Data Monitoring in Financial Services

Data lies at the heart of financial services, fueling efficient and highly informed trading. Investors and firms using the best quality data own a competitive advantage in the financial markets.

Monitor financial systems from end-to-end to triumph over tech-savvy adversaries

This whitepaper examines how traditional retail banks can leverage monitoring technology to overcome challenges from a new wave of digital competitors. Banks can achieve unparalleled visibility and compliance and ensure operational resilience by using robust end-to-end monitoring that seamlessly crosses modern and legacy IT infrastructure.